Does Insurance Cover Semaglutide GLP-1 Injections for Weight Loss?

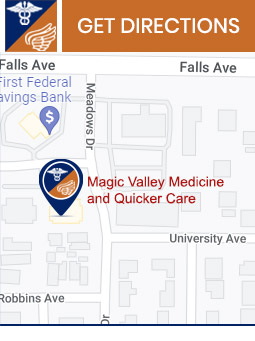

Semaglutide GLP-1 injections can help you achieve your weight loss goals by reducing appetite and promoting fat loss. Visit Magic Valley Medicine and Quicker Care to learn more about the procedure, insurance coverage, and how our medical team can support you on your weight loss journey. For more information, contact us today or schedule an appointment online. We are conveniently located at 844 North Washington St. Suite 200 Twin Falls, ID 83301.

Additional Services You May Like

Additional Services You May Like

- Walk-In Urgent Care

- Family Medicine

- Chiropractor

- Hormone Replacement

- Abscesses/Skin Infections

- Acute Fracture

- Allergies

- Back Pain Or Strains

- Bladder Infections

- Bronchitis

- Colds

- Cuts/Minor Lacerations

- Stomach Flu (Gastroenteritis)

- Semaglutide GLP-1

- Diarrhea

- Ear Infections

- Ear Wax Removal

- Eye Infections/Styes

- Fingernail/Toenail Injuries

- Hemorrhoids

- Flu

- Insect/Bee Stings

- Laryngitis

- Psychiatric Conditions (Depression/Anxiety)

- Sinus Infections

- Crush Injuries

- Knee Sprain

- Strep/Sore Throat

- Contusions

- Complex Non-Plastic Lacerations

- Eye Foreign Body/abrasions

- Minor Dislocations

- Wrist, Hand Sprains

- Swimmer’s Ear

- Sports Physicals

- Shoulder Sprain

- Ankle Sprain

- COVID Testing

- Tirzepatide

- Mounjaro

- Zepbound

- Pain Management for Chronic Pain